广州越美科技材料有限公司,始创于1991年,至今有30年历史,公司根据产业创新变革升级曾用名注册6个,现公司名为第六代,是目前国内专业生产聚碳酸酯PC阳光板,PC耐力板,具有独№立知识产权、具备进出口资格和一般纳税人资格的产、供、销一体化▃的中型民营企业。

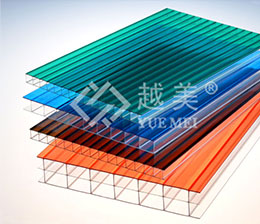

主要从事PC(聚碳酸酯)板材的研发、设计和生产,产品有:PC阳光板、PC耐力板、PC采光罩以及↘PC工程专用配件,广泛应用于公用、民用建筑的采光、遮雨天棚、通道顶棚...

30年专注于PC板材专业制造!

广州越美科技♀材料有限公司产品有:PC阳光板、PC耐力板、PC波浪板以及PC工程专用配件,广泛应用于:疫情防护板、工业机械防护板、国际机场天ω棚、航空航海安全防护板、银行防盗玻璃窗、体育场天棚、高速公路隔音屏障、浴室隔板、公交站台挡雨遮阳板、天桥通道、车棚、农业温室和广告灯箱行业等,是节能环保的阳光产业,产品销往全国30多个省、市、自治区,并远销亚、非、欧、美等一百多个国家和地区...

越美牌PC双色阳光板是中空板的№一种特殊产品,该产品外观特殊,分为上下两种颜色,室内重新营造另外一种色调氛围

越美PC深加工,产品颜色和规格可定做,应用↓范围广,广泛应用于安防设施,居家装饰、运动场馆、市政建设。

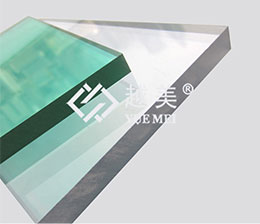

越美耐力板又称不碎玻ξ 璃,比重仅为一般玻璃的一半,抗冲击力强,透明度高,搬运〖安装省时,广泛应用商业建筑、居家装饰....

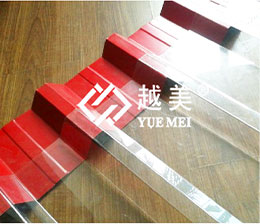

越美PC波浪板是由←进口全新料聚碳酸酯(PC)树脂工程塑料为主要原◣料,并加入抗紫外⌒ 线UV和其他化工原料采用当今的.....

全国服务热线:

400-628-9896

全部案例

AllPC板深加工

Deep processing广告标牌

Advertising屏幕显示

Screen公共设施

Communal运动场馆

Sports车棚雨棚

Carport民用采光

Civil护栏工程

Guardrail农业温室

Agricultural隔音屏障

Noise建筑装饰

Building其他

Order广州越美科技材料有限公司,始创于1991年,至今有30年历史,公司根据产业创新变革升级曾用名注册6个,现公司名为第六代,是目前国内专业生产聚碳酸酯PC阳光板,PC耐力板,具有独№立知识产权、具备进出口资格和一般纳税人资格的产、供、销一体化▃的中型民营企业。

主要从事PC(聚碳酸酯)板材的研发、设计和生产,产品有:PC阳光板、PC耐力板、PC采光罩以及↘PC工程专用配件,广泛应用于公用、民用建筑的采光、遮雨天棚、通道顶棚...

30年专注于PC板材专业制造!

遮阳棚用〓什么好?--“越美”耐力板

07-21面对高空抛落的物体,什么材料的雨棚寿命才能更长∩呢?“越美”PC耐力板又称不碎玻璃,比重仅为一般玻璃的一半,抗冲击力强。PC耐力板的冲击力◣大可达到3kg/m, PC耐力板的冲击强度是『普通玻璃的250-300倍,是亚克力板材的20-30倍,是钢化玻璃的2倍,几乎没有断裂的危险性。用3kg锤以下↑两米坠下也无裂痕,有“防弹玻璃”之美称。另外,PC耐力板重量轻,只有玻璃ζ的一半,便于搬运、钻孔、截断安︼装时,不易断裂,施工简便易加工。

阳光板♂价格多少钱一平方?

07-20阳光板∞价格多少钱一平方?这个问题很多人在买PC板的时候都会问到。那么怎样去对比阳光板价格或耐力板价格高低呢?不少商家为一己私利会在生产过程掺入←回料或者拿国产料冒充进口料,因此生』产出来的阳光板价格。也有不▅少客户因为没有接触过阳光板,或觉得我们“越美”阳光板价格太贵〓了,超出预算了或者比其他商家↙的贵出很多,但是殊不知那些板材是使用╱回料板生产的,只有多3年的质量保证。所以阳光板不∑是价格越越好。“越美”阳光板采用进口全新聚碳酸酯PC原料,板材表面均匀⌒分布有高浓度的UV防紫外线〒共挤层,可彻底阻挡紫外」线对板材的伤害

PC耐力△板会替代钢化玻璃吗?

07-02PC耐力板会替代钢化玻→璃吗?相信很←多人都有这样的疑问。纵观改革㊣ 开放几十年,PC板材的发展迅速∏占领了建筑装饰市场的巨大份额,可以这样说,90%可以用上玻璃的都可以用PC板★材来替换,不禁遐想:玻璃会被PC板〓材所替代吗?PC耐力板会替代钢化玻璃吗?广州越美简单述@说一下PC耐力板与钢化玻璃的不同。

科日∏电子休息区雾化光棚项目工程

04-2224小①时客服热线:400-628-9896;如果您对以上工程案例—科日电子休息区雾化光棚项目工程感兴趣或有☆疑问,请点击联系我们网页右侧的在线客服,或致电我们的全国☉服务热线:400-628-9896

波浪板应用▲知识

04-21波浪板是聚碳酸脂(PC)为主要原料,并加入抗紫外线剂UV和其它化工原料,采用当今∴的技术制成。波浪板具有优良的稳定性、不易黄化、变质,在紫外线光谱↓范围(290-400nm)内↘具有高度吸收强烈紫外线的能力。并且经试验证明高达99.9%的紫外▓线均可有效隔绝。 波浪板々的性能特点 1、绿色环保、材质轻、防火; 2、防变形、易安装、耐冲击; 3、隔热、隔音、防变色; 4、防潮、防胶落、易清洁;5、可自卐由组合,可进行个性化设》计。广州越美——致力成为的波浪板厂家。相关产品知识介绍Ψ ,请点击波浪板,如果您对波浪※

阳光板边卐缘坚固注意事项

04-21阳光板无论干式装配法▃还是湿式装配法,无论水平的、垂直式的和倾斜的安☆装,在阳光板安装过程中极重要的是◇边缘的紧固,注意以下两点▼:1.在连接型材中或在镶框的镶槽中留↑出有效的空间以便阳光板受膨胀和受载位移。阳光板的线性膨胀系数是7*10-5m/m.k,即温度每升高1℃,1m*1m板顺着长度方〖向各膨胀0.075mm,用户须根据工程所在地分司机温差,算出安装间隙的数据:如北方地区,高温度为40℃,低温度为-30℃,1*1m的阳光ω 板安装预留间隙为0.07*70=4.9mm。2.PC阳光板被夹持的部∩分里少要含有一条棱

全国服务热线

全球服务投诉电话:13822159616 (请短信▆联系)

地址:广东省广州市增Ψ城区宁西太新路159号

联系人:谭先生15913199158 | 邓先生 13580454576